Just How Medicare Supplement Can Boost Your Insurance Coverage Coverage Today

As individuals navigate the ins and outs of health care plans and look for detailed security, comprehending the subtleties of supplementary insurance ends up being significantly important. With a focus on bridging the gaps left by standard Medicare strategies, these supplementary choices provide a tailored technique to meeting particular needs.

The Fundamentals of Medicare Supplements

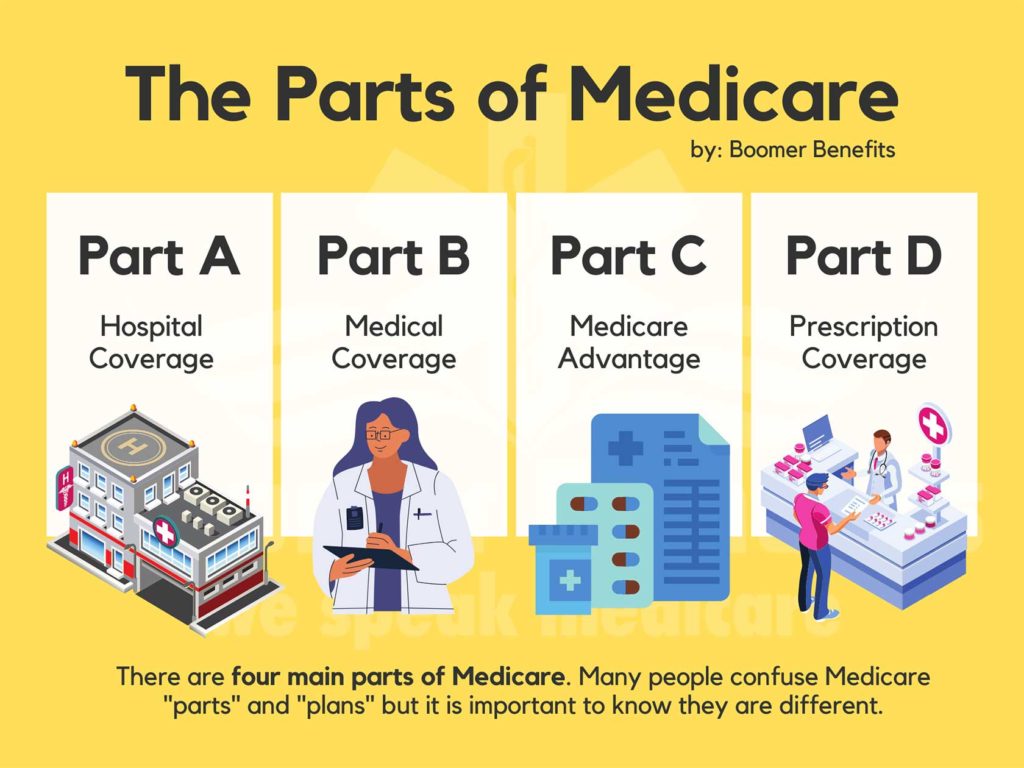

Medicare supplements, likewise understood as Medigap plans, offer added insurance coverage to fill up the spaces left by initial Medicare. These supplemental strategies are supplied by personal insurer and are made to cover costs such as copayments, coinsurance, and deductibles that are not totally covered by Medicare Part A and Component B. It's necessary to keep in mind that Medigap strategies can not be utilized as standalone policies yet work together with initial Medicare.

One trick facet of Medicare supplements is that they are standardized throughout the majority of states, offering the same standard benefits regardless of the insurance coverage copyright. There are ten various Medigap strategies identified A with N, each giving a different level of insurance coverage. Strategy F is one of the most thorough choices, covering almost all out-of-pocket prices, while other plans might supply a lot more restricted insurance coverage at a reduced costs.

Understanding the basics of Medicare supplements is crucial for individuals approaching Medicare eligibility who desire to enhance their insurance policy protection and decrease potential financial problems connected with healthcare costs.

Recognizing Coverage Options

When considering Medicare Supplement intends, it is crucial to understand the various coverage choices to guarantee detailed insurance defense. Medicare Supplement plans, likewise known as Medigap policies, are standard across the majority of states and labeled with letters from A to N, each offering differing levels of coverage - Medicare Supplement plans near me. Additionally, some strategies may use protection for services not consisted of in Initial Medicare, such as emergency situation care throughout foreign travel.

Advantages of Supplemental Plans

Additionally, supplemental strategies use a broader variety of insurance coverage options, including accessibility to health care service providers that may not approve Medicare task. Another benefit of extra plans is the capacity to take a trip with tranquility of mind, as some strategies use protection for emergency clinical services while abroad. In general, the benefits of extra plans contribute to a more extensive and customized strategy to healthcare insurance coverage, guaranteeing that individuals can receive the care they need without facing overwhelming go now financial problems.

Expense Factors To Consider and Financial Savings

Offered the financial safety and security and more comprehensive coverage options given by supplementary plans, a crucial element to think about is the price factors to consider and prospective cost savings they offer. While Medicare Supplement plans need a regular monthly premium along with the typical Medicare Part B premium, the benefits of minimized out-of-pocket expenses frequently outweigh the added expenditure. When evaluating the expense of supplementary strategies, it is crucial to contrast premiums, deductibles, copayments, and coinsurance throughout various strategy kinds to figure out the most cost-effective choice based on specific healthcare needs.

Additionally, selecting a strategy that straightens with one's health and monetary demands can lead to significant savings with time. By picking a Medicare Supplement strategy that covers a greater portion of medical care costs, individuals can reduce unexpected expenses and budget plan extra efficiently for healthcare. Additionally, some supplementary plans offer household discounts or incentives for healthy and balanced behaviors, providing more opportunities for expense financial savings. Medicare Supplement plans near me. Ultimately, buying a Medicare Supplement strategy can use beneficial monetary security and satisfaction for recipients looking for comprehensive protection.

Making the Right Choice

Choosing one of the most appropriate Medicare Supplement plan requires careful factor to consider of private healthcare needs and monetary circumstances. With a range of plans offered, it is crucial to examine variables such as coverage choices, premiums, out-of-pocket prices, copyright networks, and total value. Comprehending your present a knockout post health and wellness condition and any type of anticipated medical needs can assist you in picking a strategy that supplies thorough protection for solutions you may require. Furthermore, evaluating your spending plan constraints and contrasting premium prices amongst different plans can help ensure that you choose a strategy that is cost effective in the lengthy term.

Final Thought